04 Apr

WITH EMPTY BITCOIN MEMPOOLS, IT’S TIME TO CONSOLIDATE YOUR UTXOS

Bitcoin mempool levels are frequently empty these days, so it’s a good time to conduct this Bitcoin security best practice.

- ZACK VOELL

- APR 1, 2022

Bitcoin mempools aren’t what they used to be, at least when measured by unconfirmed transaction levels. Network use is down from the market peak in 2021, and with emptier mempools come cheaper fees, both of which have a few notable effects on the network and its users.

MEMPOOL BASICS

“Mempool” is a portmanteau of “memory pool,” which is the label given to the holding depot for Bitcoin transactions that are waiting for confirmation and inclusion in new blocks by miners. Each node has its own transaction mempool, but conversationally, Bitcoin mempools are usually referred to as “the mempool.” Mempool levels — measured by weight in virtual megabytes (vMB), total transaction count or fee volume — fluctuate with the day-to-day use of Bitcoin’s network. And when a node receives a new block, the transactions included in that block are removed from the mempool.

A relatively full mempool signals that network use is strong and miners are earning healthy amounts of revenue from transaction fees. Empty mempools signal lower network use and thus lower fee revenue for miners.

THESE DAYS, MEMPOOLS ARE FREQUENTLY EMPTY

Bitcoin mempools have been emptying regularly for the past eight months. Compared to the relatively high levels seen in mempools through April and May 2021, mempool weight in vMB and transaction have dropped and plateaued since early July 2021.

On Twitter, a tracking bot called@mempool_alert is a handy tool for monitoring when mempools are emptying. The account tweets alerts after each block that clears all transactions currently waiting in the mempool belonging to the node run by whoever maintains the Twitter account, which serves as a fairly good proxy for mempool levels for nodes across the network.

Increasing frequency of clearing the mempoolstarted in July 2021 and has continued to date with mempool levels remaining largely unchanged. The chart below shows the daily count of blocks that cleared the mempool over roughly the past two months, visualizing the latest data in this ongoing trend.

Just from this subset of recent mempool data, the timeseries shows an average of roughly 20 blocks per day that completely clear the mempool. Also, the five days with over 30 blocks that cleared the mempool stand out. And with an expected average of 144 blocks mined per day, those days saw over 20% of all blocks empty the mempool.

WHY MEMPOOLS ARE LOW

In July 2021, low mempool levels coincided with a significant drop in hash rate and price after China’s ban on mining. Usually, a drop in hash rate causes the mempool to fill up because fewer miners are processing transactions, but the mempool was emptier this time because, at the same time that miners were forced offline in China, transaction volumes on Bitcoin also dropped.

Even though bitcoin’s price set new all-time highs a few months later in late 2021, the mempool stayed empty. Hash rate and mining difficulty alsorebounded significantly late last year, but the mempool still remained empty.

Exactly why mempool levels are low is an open question. Increased adoption of Bitcoin’s Layer 2 protocols (e.g., Lightning Network) is one possible explanation. But the better question is: Does it matter?

CYCLICAL MEMPOOL PATTERNS

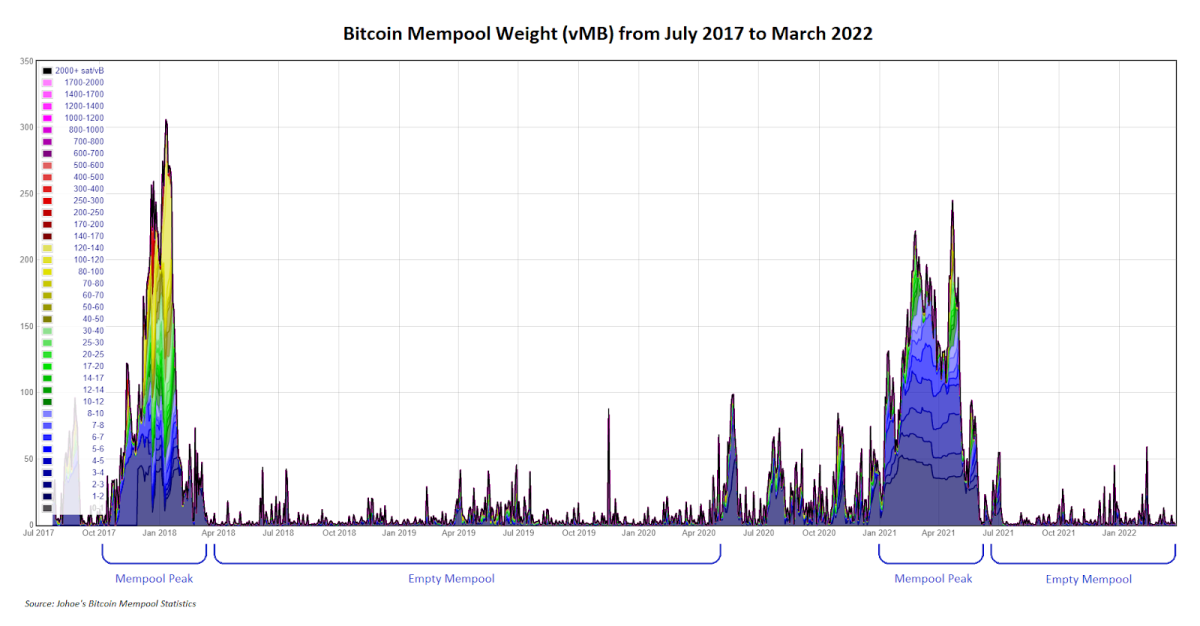

The current state of Bitcoin mempools has been seen before. As recently as the last bull market, pending transaction levels soared through late 2017 into early 2018. By April 2018, the mempool was essentially empty again and stayed that way until early 2020.

Through most of 2020, mempool levels started climbing. Transaction counts soared from January 2021 through early June 2021 before returning to their pre-2020 levels, bringing the mempool to its current, frequently-emptied state.

The screenshot below from amempool visualization built by German developer Jochen Hoenicke shows the two iterations of this mempool pattern.

And of course, this begs the question, is bitcoin in a bear market again? Making this determination based on the mempool isn’t possible, but transaction levels and low fee revenue definitely suggest fewer people today are using the Bitcoin blockchain compared to one year ago.

But it’s definitely not a bear market for miners, withhash rate and difficulty continuing to climb. And because the Bitcoin network functions well at any mempool level, users and miners are largely unaffected. The most obvious effect on miners is a significant reduction in fee revenue. At the time of writing, fees accounted for 1.08% of total block reward revenue. In the short term, this matters very little, but miners obviously expect this to not extend years into the future as the mining subsidy revenue drops with each halving.

EMPTY MEMPOOL OPPORTUNITIES

Low mempool levels mean cheap transaction fees, and discounted fees give bitcoin holders an opportunity to consolidate their unspent transaction outputs (UTXOs) in each wallet or across wallets. UTXO consolidation (or “wallet consolidation”) is simply a process of combining small bits of bitcoin in a single wallet or across many wallets into larger chunks of bitcoin represented by fewer, bigger UTXOs.

An address with many small UTXOs can be consolidated by simply spending the entire balance held by that wallet to a new address. All the various existing UTXOs will each be represented as a separate input into the spend, and the output will be a single UTXO to the new address. Consolidation accomplished. Eventually, as the new wallet receives other transactions over time, these other UTXOs can be consolidated by simply repeating this process.

Why consolidate?

Privacy, security and cheaper fees are allreasons to consolidate. Continually receiving spends to the same address(es) is a notoriously bad Bitcoin privacy practice. Address reuse is important, and with added privacy comes additional operational security.

Consolidating UTXOs allows spending lighter transactions (measured by vMB weight), and when network use rebounds, this reduces overall transaction fees spent by a user that consolidated. The bigger (or heavier) a transaction is, the more expensive it becomes. And transactions with multiple inputs (aka, distributed UTXOs) are more expensive than transactions from a consolidated wallet. Consolidation is generally brought to the fore of conversation on social media when fees are low and the mempool is empty, not when network use is high because consolidating in these conditions defeats one of the purposes (i.e., cheaper spends).

Privacy is also a concern when consolidating. Mixing funds from public or KYC’d addresses with private or anonymous addresses, for example, would hurt more than help a user’s privacy, for example. And there’s never a good reason to consolidate all funds into a single address.

With little indication that mempool levels will suddenly increase and transactions become more expensive, readers probably have some time to consider their own UTXO consolidation and read more about the process. Here are a few supplemental resources that will help a novice planning to consolidate:

- Casa published a helpful explainer on UTXO consolidation.

- Andreas Antonopoulos produced a short video explaining UTXO consolidation.

- Reddit users on r/Bitcoin shared helpful comments on UTXO consolidation here.

CONCLUSION

Mempool levels are low, and the network is possibly repeating a post-bull market mempool cycle from late 2017. But even as mempools are clearing more frequently, the network continues operating normally, even if miners are earning significantly less fee revenue. And periods when the network is relatively underutilized and transaction levels are low are opportune for consolidating UTXOs. The mempool will inevitably start filling up at some point in the future, but for now, almost no one is complaining about cheap fees.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.